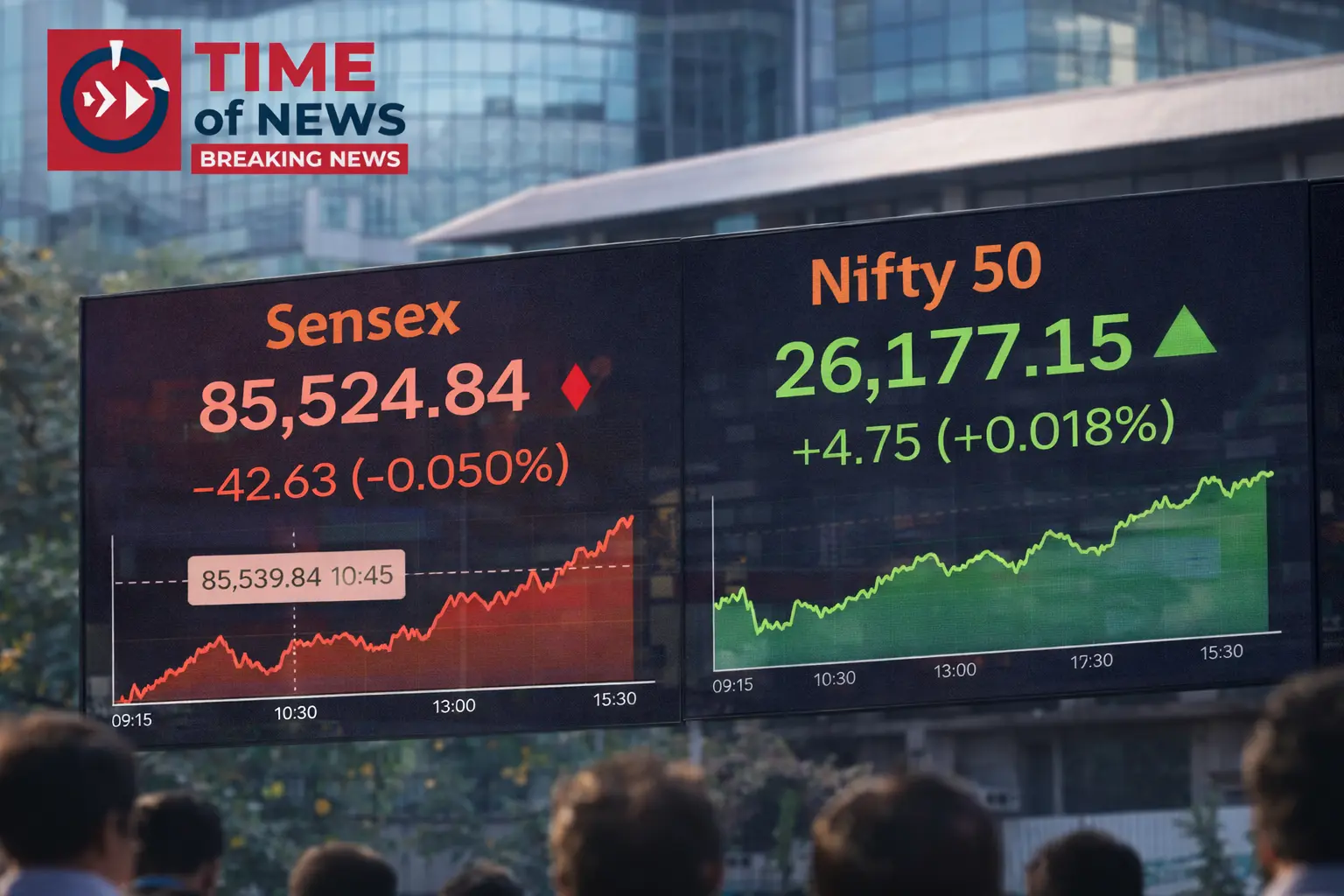

Indian equity markets slipped sharply today, weighed down by sustained foreign-institution selling, weak global cues and renewed trade-tension concerns — with both Sensex and Nifty 50 ending significantly lower

Indian stock markets witnessed a steep decline on 9 December 2025 as investor sentiment soured amid persistent foreign outflows, soft global signals and mounting worries over potential trade tensions.

The BSE Sensex closed down around 436–490 points at approximately 84,611.89, while the Nifty 50 fell nearly 155 points to end near 25,805.60.

Sector-wide selling saw major losses in IT, auto and metals, while mid-cap and small-cap stocks outperformed moderately — showing some resilience in a broadly weak session.

The Economic Times

Market watchers attributed the sell-off to a combination of factors: a sharp drop in foreign institutional investor (FII) flows, a weaker rupee, and uncertainty over a possible U.S.–India trade dispute — particularly fresh talks around export tariffs.

Additionally, the upcoming rate decision by the Federal Reserve in the United States has kept global investors cautious, dampening risk-appetite across emerging markets including India.

The Economic Times

As the markets try to digest these developments, analysts suggest investors may remain on the sidelines until clarity emerges — either from global central-bank actions, trade-policy outcomes or a stabilisation in foreign-inflow patterns.