Global and domestic markets witnessed cautious trading as investors assessed mixed economic signals, geopolitical developments, and expectations around future interest rate moves

Muted Sentiment Across Markets

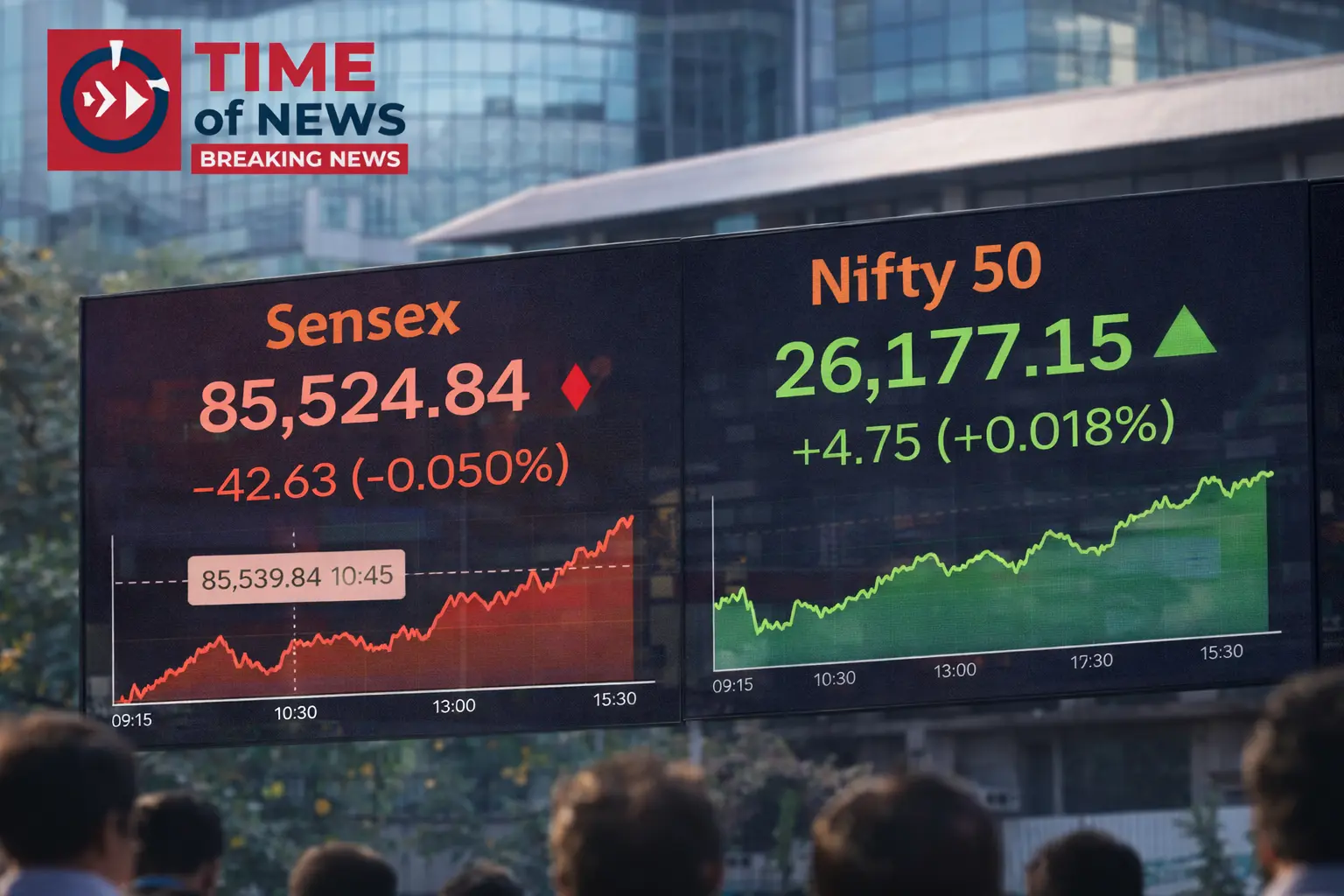

Equity markets opened on a subdued note and struggled to gain momentum as weak global cues weighed on sentiment. Concerns over slowing global growth and fluctuating commodity prices limited risk appetite, prompting investors to stay selective.

Sectoral Performance

Defensive sectors such as consumer staples and healthcare showed relative resilience as investors sought stability. Meanwhile, technology and metal stocks faced selling pressure due to uncertainty around global demand and currency movements.

Financial stocks traded in a narrow range, reflecting caution ahead of policy-related announcements and economic indicators that could provide clarity on future growth prospects.

Key Factors Impacting the Market

-

Ongoing global economic uncertainty

-

Volatile commodity and energy prices

-

Expectations around interest rate direction

-

Investor focus on upcoming macroeconomic data

Expert View

Market experts believe the current phase reflects consolidation rather than a trend reversal. According to analysts, short-term volatility is likely to continue as markets react to global news flows and economic signals.

Outlook

In the near term, markets are expected to remain range-bound with stock-specific action. Investors are advised to focus on fundamentally strong companies and maintain a long-term perspective while navigating short-term fluctuations