Indian stock markets closed on a mixed note today after a highly volatile trading session, as investors remained cautious amid weak global cues, fluctuating crude oil prices, and uncertainty around interest rate outlooks.

Indian Stock Market Ends Volatile Session Mixed as Investors Track Global Cues

Indian stock markets witnessed sharp intraday volatility on Tuesday and eventually closed on a mixed note, as investors remained cautious amid weak global cues, rising bond yields, and uncertainty surrounding future interest rate decisions.

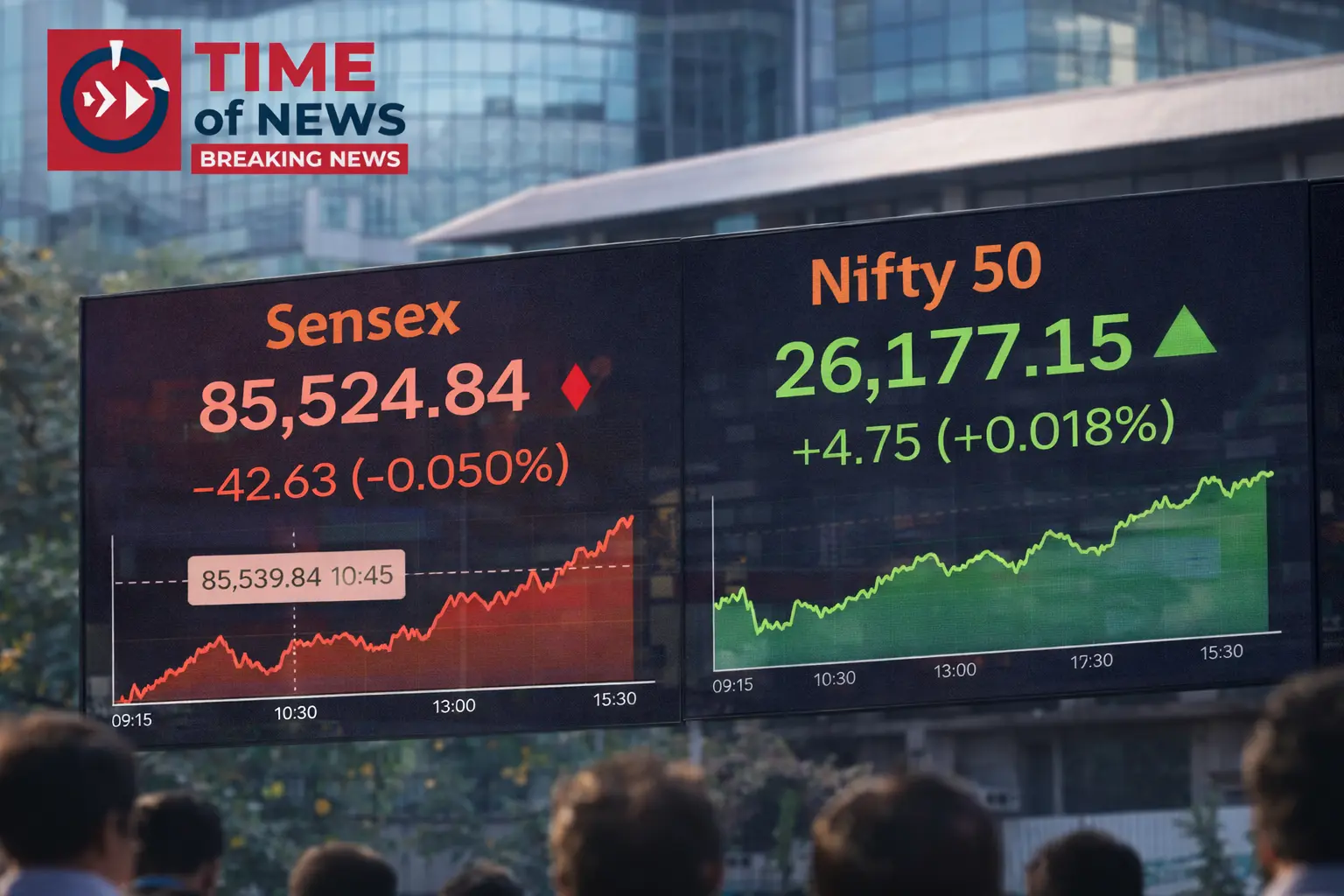

Market Performance Overview

Benchmark indices struggled to maintain early gains throughout the session. Buying interest was seen in select banking and FMCG stocks, while IT and metal shares remained under pressure due to concerns over global economic growth.

Mid-cap and small-cap stocks underperformed the broader market, reflecting a risk-off sentiment among retail and institutional investors. Market participants preferred to stay on the sidelines ahead of key global economic data releases.

Key Factors Influencing the Market

- Global Market Trends: Weak cues from Asian and US markets weighed on investor sentiment.

- Crude Oil Prices: Rising crude prices increased inflation concerns for the domestic economy.

- Interest Rate Outlook: Uncertainty over future rate cuts kept investors cautious.

- FII Activity: Foreign investors remained selective, leading to limited upside in frontline indices.

Sectoral Performance

Banking and financial stocks showed resilience, supported by expectations of stable credit growth. FMCG stocks gained marginally as defensive buying emerged in uncertain market conditions.

On the other hand, IT stocks faced selling pressure due to muted demand outlook from key global markets. Metal and realty stocks also declined as investors booked profits after recent rallies.

Expert View

“Markets are currently in a consolidation phase. Investors should focus on fundamentally strong stocks and avoid aggressive short-term trades until global clarity improves,” said a market analyst.

Market Outlook

Analysts expect markets to remain range-bound in the near term, with stock-specific action dominating trade. Global economic indicators, inflation data, and central bank commentary will continue to influence market direction.

Investors are advised to maintain a balanced portfolio, keep a close watch on global developments, and avoid panic-driven decisions during volatile sessions.

— Reported by TimeOfNews Market Desk