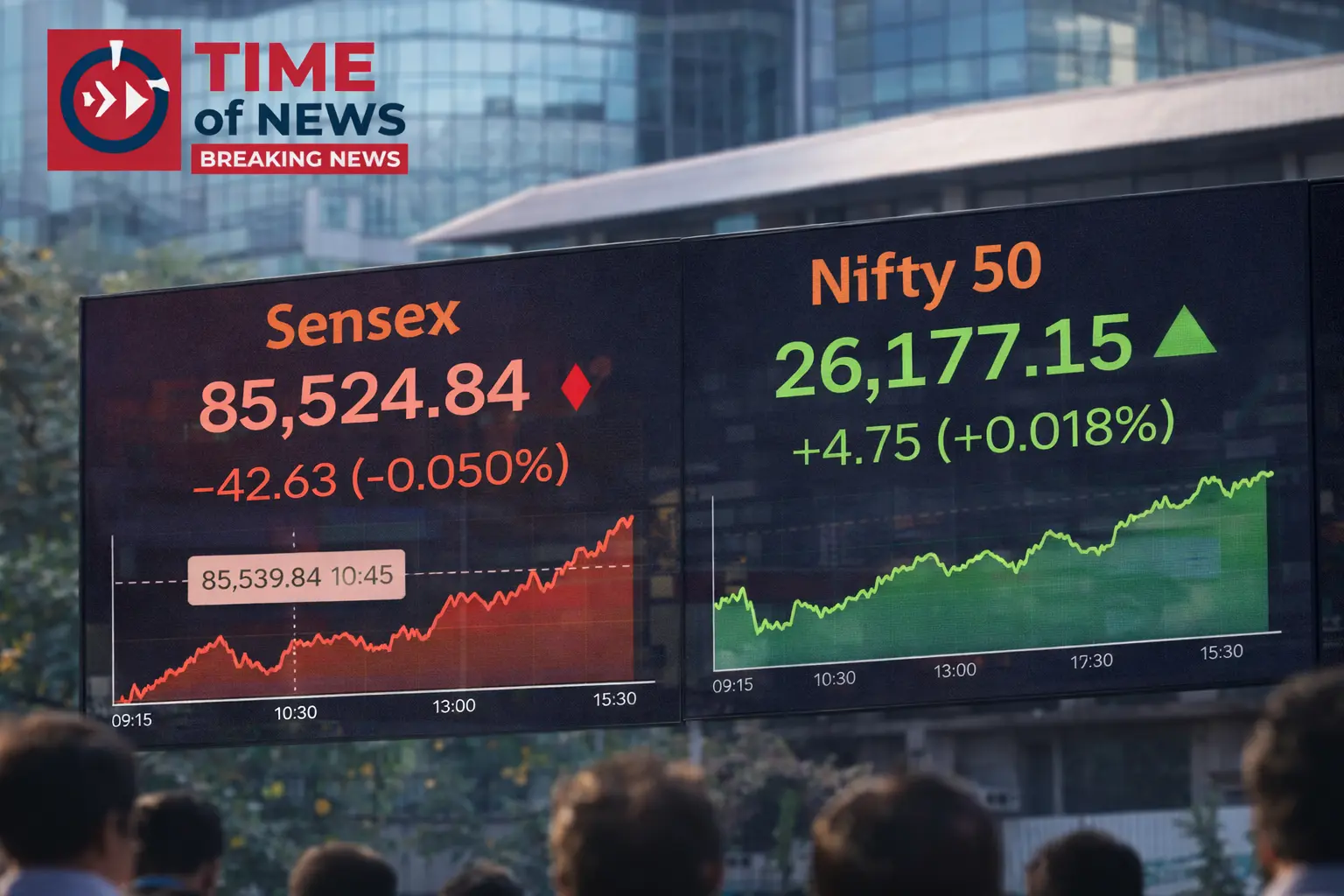

India’s benchmark stock indices Sensex and Nifty50 are hovering near record highs, showing strong resilience despite weak cues from Asian markets. Investors remain optimistic while selectively hunting for year-end opportunities

India’s stock market continues to display remarkable strength, with benchmark indices Sensex and Nifty50 trading close to their all-time highs, even as several Asian markets struggle with mixed global cues. The steady performance reflects sustained investor confidence in the Indian economy and corporate earnings outlook.

Market participants say that domestic fundamentals remain supportive, helping Indian equities outperform peers in the region. Strong participation from domestic institutional investors and steady inflows into select sectors have helped markets stay buoyant despite cautious sentiment overseas.

Analysts note that investors are now closely tracking year-end opportunities, focusing on fundamentally strong stocks that have underperformed in recent months. Sectors such as banking, infrastructure, capital goods, and select IT stocks are seeing renewed interest amid expectations of stable growth in the coming quarters.

At the same time, global factors such as U.S. interest rate expectations, crude oil prices, and geopolitical developments continue to influence short-term market movement. Experts believe that while volatility may persist in the near term, India’s long-term growth story remains intact.

Market experts advise investors to stay selective and avoid aggressive bets at higher levels, recommending a balanced approach with focus on quality stocks, strong balance sheets, and consistent earnings growth.

As the year draws to a close, traders expect markets to remain range-bound with a positive bias, supported by domestic demand, government spending, and improving corporate performance